Let's be honest, if you bought your home in the last few years when interest…

How Halloween's History Connects to Homeownership: Spooky Tales & Mortgage Tips

Who knew that Halloween and homeownership had so much in common? Both involve spirits (one supernatural, the other financial), both can give you nightmares, and both have a rich history of people doing whatever it takes to secure their "home sweet home."

As your friendly neighborhood mortgage loan officer, I've seen my fair share of scary mortgage situations – and trust me, some of them make ghost stories look like bedtime fairy tales. But before we dive into the real horrors of homebuying mistakes, let's take a fun trip back to Halloween's spooky origins and see how they connect to the world of real estate.

When Ghosts First Started House-Hunting

Halloween traces its roots back to the ancient Celtic festival of Samhain (pronounced "sow-in"), which literally means "end of summer." The Celts believed that on this night, the boundary between the living and dead became blurred, and spirits would return to visit their earthly homes. Talk about the ultimate open house event!

These ancient homeowners took ghost visits pretty seriously. They'd light bonfires and make sacrifices to protect their families and property during the long winter months ahead. When you think about it, they were basically the first home security system – just with a lot more supernatural flair.

Fast forward a bit, and Christians transformed this pagan festival into All Souls' Day. The tradition evolved into something that sounds remarkably familiar to modern trick-or-treating: poor folks would go door-to-door at wealthy homes, receiving "soul cakes" in exchange for prayers for the homeowners' deceased relatives. It was like the world's first neighborhood watch program, except instead of keeping an eye out for burglars, they were praying for your great-aunt's eternal soul.

The Modern Haunted House Market (It's More Popular Than You'd Think!)

Here's where things get really interesting for us in the real estate world. You might assume that a house with a ghostly reputation would be impossible to sell, but you'd be dead wrong (pun intended). According to recent surveys, about 65% of Americans would actually consider buying a haunted house, and 61% of homebuyers believe in ghosts.

Now, I'm not saying you should start advertising properties as "ghost-friendly," but there's clearly a market out there for homes with a little supernatural character. In fact, 29% of buyers are actually attracted to homes with spooky reputations, especially if they come with historic value or unique architectural features.

The real kicker? Price matters more than poltergeists. Studies show that 70% of potential buyers would accept a haunted house if it came with significant savings, and that number jumps to 82% when the property is listed below market value. Suddenly, sharing space with Casper doesn't seem so bad when you're saving $50,000, does it?

Some of the most famous "haunted" properties have become goldmines precisely because of their spooky reputations. The Amityville Horror house and Lizzie Borden's former home in Massachusetts are perfect examples of how a dark history can actually increase property value when marketed correctly. These homes can sell for up to 26% more than comparable non-historic properties in the same area.

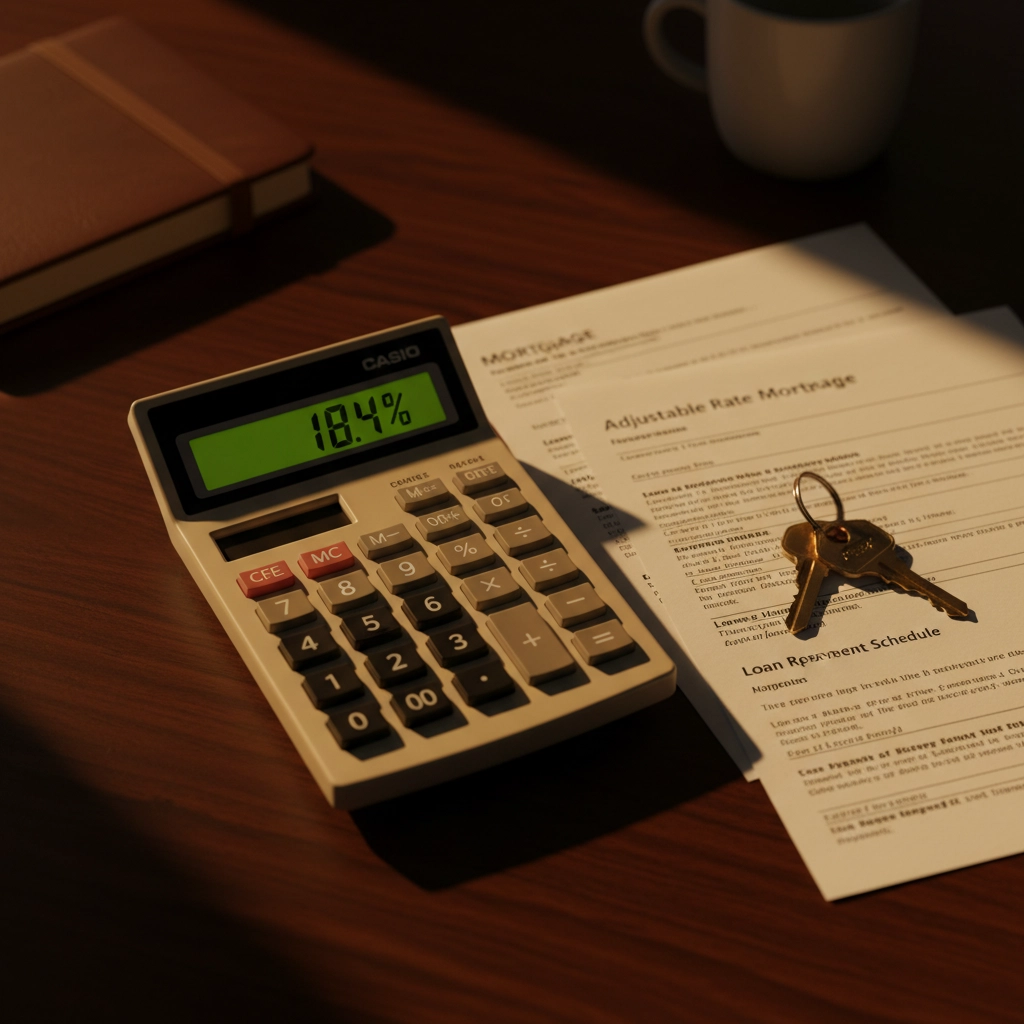

The Real Horror Story: Mortgage Rates in 1981

Speaking of scary, let me tell you about the truly terrifying Halloween of 1981. Forget about ghosts and ghouls – that year, mortgage rates hit a bone-chilling 18.4%! To put that in perspective, if you bought a typical home that Halloween, your mortgage payment would have consumed about 73% of a median household's income. Now that's what I call a real nightmare scenario.

Imagine explaining to your spouse that your monthly mortgage payment was going to cost more than your take-home pay. "Honey, I have good news and bad news. The good news is we got the house! The bad news is we'll be eating ramen noodles for the next 30 years."

Thankfully, we've had some much friendlier Halloweens for homebuyers since then. The best ones were probably 1971 (7.63% rates), 2011 (4.10% rates with home prices still recovering from the 2008 crash), and 2020 (an incredible 2.8% average rate that required less than 34% of median income for a home with 5% down).

Avoiding Real Homebuying Horror Stories

While we're on the topic of scary mortgage situations, let me share some real-world tips to help you avoid the kind of homebuying nightmares that make ghost stories look like comedy sketches:

The "Too Good to Be True" Trap

Just like that suspiciously cheap haunted mansion, if a mortgage deal sounds too good to be true, it probably is. Watch out for lenders offering rates significantly below market average – they might be hiding fees, have terrible customer service, or disappear faster than a ghost at sunrise.

The Inspection Specter

Never, and I mean never, skip the home inspection. I don't care if the seller swears the house is perfect or if you're competing with multiple offers. A proper inspection can save you from discovering that your dream home comes with surprise "features" like a basement that floods, electrical work that belongs in a horror movie, or a foundation with more cracks than a haunted house's walls.

The Credit Score Phantom

Your credit score can haunt you long after Halloween is over. Even a few points can mean the difference between a great rate and one that will give you nightmares for decades. Before you start house hunting, check your credit report and address any issues. Trust me, it's better to face these demons early than to have them jump out and scare you during the loan application process.

The Down Payment Goblin

Don't let anyone convince you that you need 20% down to buy a home – that's an old wives' tale scarier than any ghost story. We offer programs that allow qualified buyers to purchase with as little as 3% down, and VA loans require no down payment at all for eligible veterans.

The Rate Lock Vampire

Mortgage rates can be as unpredictable as a poltergeist throwing dishes around your kitchen. Once you find a good rate, lock it in! Don't gamble on rates dropping further unless you enjoy the thrill of potentially paying more for your mortgage than necessary.

Making Friends with Your Mortgage (It Doesn't Have to Be Scary)

Here's the thing about mortgages – they don't have to be frightening. With the right lender (hint, hint), the process can actually be pretty straightforward. At Affinity Group Mortgage, we've helped thousands of people navigate the homebuying process without the scary surprises.

Whether you're looking to purchase your first home, refinance your current mortgage, or explore specialized loan programs, we've got the tools and expertise to make your homeownership dreams come true – no séance required.

The Sweet Ending to This Spooky Tale

As we wrap up our Halloween homeownership journey, remember that while ghosts might be optional in your next home, a good mortgage definitely isn't. The scariest thing about buying a house shouldn't be the mortgage process itself – it should be wondering whether that creaking sound upstairs is just the house settling or your new spectral roommate.

This Halloween, instead of worrying about things that go bump in the night, focus on the real financial ghouls that can haunt your homebuying experience: poor credit preparation, inadequate research, and choosing the wrong lender.

Ready to start your own homeownership adventure? Get a quote today, and let's make sure your home buying story has a happy ending – ghost sightings optional, but great service guaranteed!

After all, the only thing scary about working with us is how easy we make the mortgage process. Now that's a treat worth celebrating!